Table of contents

After gaining initial traction, many startups chose the venture path to double down on growth. However, raising your first round can be a time-consuming process, especially for first-time entrepreneurs that lack the network to start with and the tools to handle first contacts.

Fortunately, LaGrowthMachine is here to help you reach investors on a scale. Using our free custom-built database of investors and the power of personalized cross-channel sequences, you’ll be able to cope with the lack of network, warm them up before getting in touch and get a chance at pitching business angels and funds.

It’ll then be up to you to convince them of your amazing vision, execution, and ambition.

In this GrowthMaster post, we’ll share with you:

- How to use our custom-built database to search for investors that match your startup

- How to craft a convincing pitch sequence of emails that will get you a response

We will take LaGrowthMachine as a fictional example. Fictional because for those that know us well, LaGrowthMachine is a bootstrapped company.

Chapter 1: Finding the right investors, on a scale

Seed fundraising starts with identifying the right investors that have an investment scope matching your company. It’s not wise to mass-contact investors through any database you may find without proving first you’ve done your research.

We’ll walk through different approaches you should use to build your list of potential investors.

Introductions from your network

Getting an introduction from a trusted person is a golden ticket to actually pitching investors. Before using databases, reach out to your incubator/accelerator, fellow entrepreneurs, and friends. Entrepreneurs are your best chance at getting introductions, as they’ve probably gone already through the painful process of raising money and building up relationships with investors.

Quick tip

The first step to get seed funding is spreading the word about your business. Network, attend events (online AND offline), and stay active on social media. This will dramatically increase your chances of getting those investors.

Using databases

It’s always best to get an introduction from a trusted person, but like many first-time entrepreneurs, you might now have that opportunity. The other approach relies on using databases:

- Angel.co: if your company is based in the USA, you’re best using AngelList as your source for investors. However, outside of the US, the platform isn’t that popular with investors

- Crunchbase: Second best source, if not the most reliable, to find investors.

- Linkedin: if you have startups in your sector that have raised money as an example, it’s fairly easy to find their investors on Linkedin (search for keyword “angel” OR “investor” at the company). However, even with LaGrowthMachine’s built-in custom Linkedin company search, it can be very time-consuming to do so.

Then there is LaGrowthMachine’s Business Angel Bible: Gritt.io. It’s a custom-built database of all the above, in which you can find your institutional and angel investors per country or past investments, and import the results as a CSV into LaGrowthMachine.

Don’t contact everyone, do your own research

While it’s tempting to contact everyone on the list, investors hate receiving generic emails. It’s important to do your own research and check that:

- their portfolio (LaGrowthMachine’s Business Angel Bible – Gritt.io is great for that) matches your sector.

- their ticket size matches your funding stage

Reaching out to a SaaS investor if you’re a MedTech will lead you nowhere. Same if you reach out to Series B investors while raising a seed.

Combining it all together

If you’re using the databases above, you’ll be able to build a CSV containing the first name, last name, LinkedIn URL, and past investments as custom variables matching your scope. While not mandatory, using past investments as justification variables will help you increase the reply rate significantly, because it’ll show you have done your research.

Upload the result of your research into LaGrowthMachine. To do so, go to Leads and click on “import leads” and then click on “Import CSV”.

Get 3.5X more leads!

Do you want to improve the efficiency of your sales department? With La Growth Machine you can generate on average 3.5x more leads while saving an incredible amount of time on all your processes.

By signing up today, you’ll get a free 14-day trial to test our tool!

Chapter 2: Crafting a behavior-based cross-channel sequence

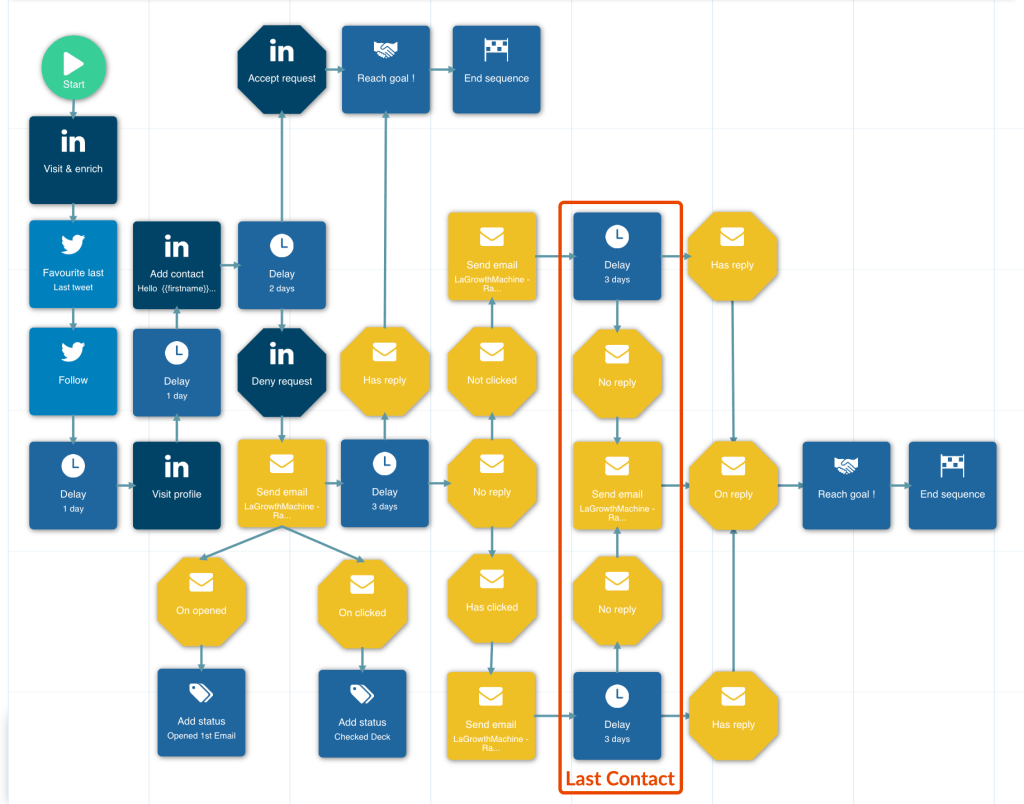

Investors get solicited by startups all day long. Blasting emails and generic Linkedin requests will have a very low chance of converting. In order to stand out, it is necessary to have a conversational approach by first warming up the investor and then getting in touch, based on the lead’s behavior.

Step 1: Warming Up Leads

Warming-up an investor isn’t easy. Probably they’ve never heard of you nor your company. We break down this barrier by creating proximity and first visiting his profile long enough to send a notification to the lead. Then LaGrowthMachine will like his latest tweet and follow him and visit the profile again a day later.

People can’t help being curious about who showed interest in them. These subtle actions almost always result in your lead researching you or your company

Step 2: The First Hook

You’ve created proximity and trust with basic human interactions. It’s now time to contact them. Linkedin has a 300 character-limit on connection requests. Your copy has to be straight to the point. We recommend mentioning:

- Selected past investments as variables – to explain why you hunted them. Investors appreciate indications that you’re not just mass-reaching out

- The fundraising amount and target – to be clear on the expectations

- Your best metrics that demonstrate traction – to prove you’re worth their time. Avoid Vanity Metrics at all costs.

- To schedule a call for more information as a CTA

Having first warmed up the lead and providing strong value through research and metrics should end up with a decent positive reply rate. Don’t expect too much at this point, as Linkedin isn’t investors’ first choice when it comes to getting deal flow.

But what do we do if your potential investor didn’t reply?

Step 3: Switching to email

Despite doing great research and sending an impressive copy, your reply rate will probably be quite low. That’s because most investors get overwhelmed on Linkedin. Hopefully, it’s very easy to follow up via email with LaGrowthMachine, since you’ve used the enrich function to automatically find their email.

On email, you have no theoretical limit on length, but avoid boring out potential investors with long emails. Nobody will read it: precision is of the essence.

First off, the subject line has to compel email opening. Lead with value: “Startup investment opportunity” will never work”. Arise interests “LaGrowthMachine – Raising 1m€ – 22% MoM, 70k€ MRR” is just the right mix: straight to the point and providing compelling metrics to prompt a read.

Now the copy:

- First, mention your previous attempt of connecting via Linkedin. This will provide reassurance that it’s not an automated email sequence. Even though we all know it’s sort of it

- Explaining why you chose to contact them with custom variables based on their past investments. Again, to show you’ve done your research and provide assurance on the quality of your work

- Briefly introduce what your company does. We couldn’t do it on Linkedin because of the 300-characters limit, but now is the time.

- Prove you’re the best at what you do either:

- Your current metrics. Pay attention to what you will provide. Don’t forget to avoid Vanity Metrics at all costs.

- Social proof. Testimonials from well-known clients, investors, or influencers of your industry.

- Attach your deck. There are debates as to sending decks upfront. Most investors do prefer to be able to make up their minds before committing some time to exchange with you. Moreover, we’ll use that link as a personalization factor for the next email in the sequence

If you feel you need more training on copywriting to investors, do check out Bill Wilson’s article on how to send the perfect cold email to an investor.

Step 4: So you liked my deck?

By now if the prospected investor hasn’t replied, it isn’t a great sign. Let’s assume they just didn’t have time to review or reply and send another email. This time taking into account what they’ve done.

This is where providing the deck comes in handy. Links and attached we send through emails can be tracked. If the lead clicks viewed the deck, it must be that you got his curiosity, but not yet his attention.

Let’s use that knowledge to our advantage to yet again reassure the potential investor with behavioral personalization. Looking carefully at the template, you’ll see that we divide our actions based on two behaviors:

- “Did not reply” AND “Has clicked”

- “Did not reply” AND “Has not clicked”

The former allows us to write an email with a mention of the deck they read as the first sentence.

Don’t forget to update your leads on new commitments. You can always update the template of an email in the “Templates” Tab, even after the start of a Campaign. Letting investors know more people are committing can generate Fear of Missing Out (FOMO).

For the latter (i.e. hasn’t clicked), since we know they haven’t read the deck, it’s good practice to put it again. As mentioned before, if committed money increases, don’t forget to mention it to generate some FOMO.

Step 5: Last chance

If the potential investor didn’t reply by then, there is a high probability that he isn’t interested. It could also be that the investor interpreted your deck wrong. To make sure, let’s send one last email asking why they turned you down. Not only it is a good way of closing the loop, by showing you’re appreciative of feedback, but it may also help you improve. And if indeed they interpreted badly some elements of your deck, you’ll get a chance to defend yourself.

Chapter 3: Results

Comments